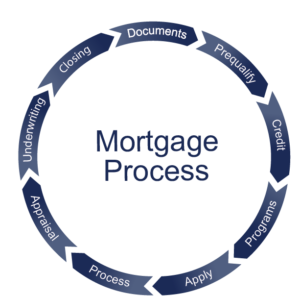

Mortgage loan processing is a popularly outsourced business process in the USA. This is mainly because of the challenges involved in mortgage loan processing in terms of the steps and paperwork involved. Most of the mortgaging firms appoint an outsourcing Mortgage And Foreclosure Service provider to take care of the end to end mortgaging processes. This makes the entire process easy and more efficient. Most of the reputed and competent outsourcing firms offer end to end solutions such as application processing, data entry, title checking, underwriting, collections, and foreclosure services. The following processes come under the outsourcing team as far as mortgage loans are concerned:

Business Acquisition Mortgaging

When it comes to business acquisition mortgaging, the challenges get a little different and slightly complex too. There are many aspects to consider including loan form data entry and processing which need to be done diligently. Businesses usually outsource the same to a competent offshore mortgage processing services provider who has ample experience in handling the processes efficiently. They will undertake all the required documentations and verifications. This will ensure a smooth mortgage loan processing experience for both the parties involved.

Title Checks

Every mortgage business essentially need title checking. Title checks include the following processes:

- Credit checks

- Title checks

- Property valuation

- Legal clearance

The document titles are thoroughly checked for any existing cases, claims or judgements. Title checking is done by outsourcing partners since they have the right tools and tie-ups to cross-check the details and verify them. If any issues are found with the title, they also help the client to sort out the problems and get a clear title. It is a time-taking process which businesses usually prefer to outsource. It is better to outsource foreclosure services to a single third party that offer end to end mortgaging solutions. This will ensure data consistency, smooth data flow, better efficiency and faster completion of the entire mortgage process.

Underwriting Services

Underwriting is another important aspect of mortgaging. The outsourcing parties usually offer underwriting services as a part of mortgage process outsourcing. This process basically involves evaluation of the credit score and estimation of the appraisal amounts. When you outsource mortgage loan processing services, the outsourcing partners will have access to a licensed application that lets them cross-check the credit score and ratings of the applicant. This majorly influences the appraisal amount and mortgage rates.

Collection Services

Mortgage outsourcing not only offers mortgage processing and foreclosure services but also extends assistance on overdue collections, overdue payments processing, and asset management which are also essential to maintain good customer relations and cash flow. Good customer relations can be maintained when the processes are completed swiftly and smoothly. Accomplished collection agents know how to ensure better collections and will ensure better cash flow without many defaulters. This not only increases the cash inflow but also ensures better customers relations.

Outsourcing mortgage loan processing services in the USA is essential because it helps the businesses to focus on their core activities while the outsourcing partner handles the tedious and monotonous processes.