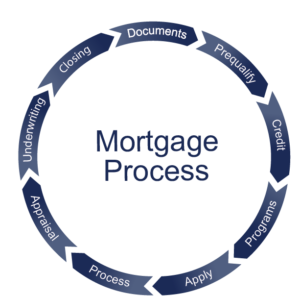

Real estate is a highly competitive business across the globe. They deal with a lot of data and documentation that are critical to sustain in the market. To be successful and rise above competitions in real estate business, the companies need to be adept with advanced document digitization and data entry services. A real estate business has to deal with property papers, valuation documents, sale deeds, and other legal papers. Such documents should be easily accessible to take any critical business decision. Document management becomes an integral part of this industry and the resources could be well utilized by outsourcing certain tasks. The mortgage processing services being one of them where all the documents can be organized in a digital form which makes the process easier and less time-consuming.

Underwriting and other Documentation

A mortgage document system requires a lot of documents to be exchanged within the organization. They should be kept in a standard form and include options to supplement supportive documentation with data capturing if required though it takes a lot of time. A specialized tool or software can help in gathering information and free the team to spend time on approvals. Outsourcing eases out these hassles. The final step of the mortgage process is underwriting which finds the payment capacity of the person or a firm who has applied for the mortgage loan. The mortgage underwriting services relieve the company from hiring underwriter for this crucial step. Instead, the outsourcing partner can use automated software to check this on various factors. Such factors majorly are applicant�s income, debts and credit score. All these can be carefully analyzed to find the repayment capability.

Data Optimization and Security

Secure mortgage processing has become a challenge nowadays with the constant changes in regulatory measure, higher costs, and technology. Reliable and proven outsource mortgage BPO services improve the company�s performance in the market. It firstly keeps the company free from the hassles of managing large amounts of data in a professional way. Few services which are provided by such companies for better document management are as below:

- Indexing the documents and classifying as per the types.

- Collection of information for loan eligibility evaluation.

- Verification of all the documents provided.

- Ordering any third-party document required for the review.

- Initial submission for underwriting.

- Post closure conditions as per the government regulatory guidelines.

Digitization and Automation

Though the digitization and automation has reduced the time required for any outsource mortgage application processing, it does not ensure full transparency in the process. The risk lies here when fraud applications also go through the process. The company too can land into huge financial problems. Once the company decides to outsource mortgage processing to a professional company, it not only speeds up the process, but also increases the accuracy and reduces the costs of hiring skilled people. Through such assessments of applications and analysis, a quicker mortgage loan processing comes as an output.

File and Data Processing

For the business mortgage application form filling and data processing are an important part of the mortgage data entry work. The data entry project comprises of form scanning, form processing like automated form processing or manual form processing. This process does not require any calculation or risk evaluation but still takes a lot of time since the information entered in the forms should be accurate. Outsourcing this works as huge volumes of work are handled while maintaining the quality in a short time. This altogether reduces the total time in clearing mortgage applications.

A team of highly skilled and focused professionals use advanced software and document management system to keep track of all the important documents and offer underwriting, mortgage closing, and post-closing support. Owing to the complexities and challenges involved, outsource mortgage processing is the current trend which helps the real estate businesses to flourish and sustain.